INVEST in the Future

of Your Business

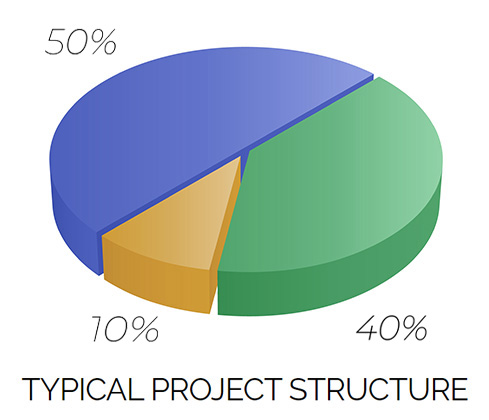

Collaborating with the U.S. Small Business Administration and Lending Partners across the state of Georgia, Capital Partners Certified Development Company invests in Small Businesses, assisting them with the purchase of Real Estate through the SBA 504 Loan Program.

Helping Businesses Finance Their Growing Businesses

Your Partners in Financing 504 Loans for Your Clients

Resources and Tools for our Existing Clients